Lynne Lamont

- Head of Charities UK, Brewin Dolphin

As pandemic-era support recedes, charities are once again faced with a familiar challenge: balancing rising costs against unpredictable sources of income. This picture has been further complicated by soaring inflation driving up wages and energy costs in particular for our operational charities.

The financial landscape for charities has fluctuated dramatically but the sector has shown resilience and innovation at a time of great challenge.

Now, Trustees and Executives must decide how best to manage reserves at a time of a parallel sea change that has taken place within the investment world which will impact decision making around board tables.

Throughout much of the last decade, interest rates have been sitting at historically low levels. In such an environment, the choices were clear. For reserves held in cash, boards had to accept a near zero return. For a more attractive level of return, investors were pushed towards higher yielding, but more volatile equity markets. This led to tough decisions around how much cash to keep in reserve, and how much could be committed to long-term investment to generate returns ahead of inflation. It has been a fine balance between maximising returns and operational efficiency and retaining sufficient cash in reserve.

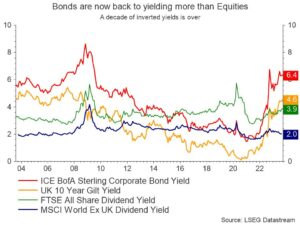

The good news is that the choice is now not so stark. In September, UK interest rates reached 5.25%. Admittedly, current rates are not high from a historical perspective. Nevertheless, it is the pace of the increase from a historically low base that has meant, suddenly, the relationship between income yield and risk has been inverted.

A 10-year UK government bond now yields more than 4%, with corporate bonds offering significantly more. Even cash rates are now far more attractive, with some deposit accounts offering north of 5% – rates that were unthinkable even a year ago. This compares to the 3.9% income yield generated by the UK equity benchmark, or the 2.1% income yield generated by the S&P 500 index in the US.

Given current strains on finances, many organisations are understandably focused on the short-term capital needed to service rising operational costs and manage income shortfalls. Amid a number of dark clouds, the improving income picture for low-risk assets offers a welcome silver lining. With many charities relying on income from more unpredictable sources such as donations, legacies, and fundraising, the attraction of cash term deposits as a source of relatively stable and recurring revenue is clear.

After a challenging 2022 for equity returns, the question that inevitably arises is: why should charities take on equity risk at all in this environment? Of course, income is only one part of the overall return. The picture is incomplete without considering capital return and the vital role this plays in combatting inflation. Over longer timescales, the risk of inflation eroding the spending power of funds rises. Given a long enough time horizon, the risks associated with short-term volatility become secondary, while the impact of inflation becomes paramount. This remains the domain of equity investment.

For example, every £1 invested in the US stock market just before economies were gripped by the Global Financial Crisis would today be worth £4, still comfortably more than £2 after adjusting for inflation. If the same £1 had been held in cash during this period its spending power today would be little more than 50p. Currently, with inflation sitting stubbornly high at 6.7%, even interest rates of 5.25% are insufficient to protect the spending power of assets. If the cash will be spent in the coming months, this is somewhat immaterial, but over a number of years this cannot be ignored.

Trustees and Executives are acutely aware of the need to manage short-term reserves prudently to meet the immediate challenges facing them. When considering short-term funding needs, preservation of capital and liquidity are the focus. A sharp uptick in interest rates has widened the options available, easing decisions around retaining cash in uncertain times.

Of course, we all have an interest in ensuring charities can continue to make their invaluable contribution for generations to come, and thus, it remains vital that their finances are structured to meet not only the challenges of today, but those in the decades ahead.

For organisations that are able to take a longer-term view with their reserves management, equities still have a vital role to play in growing the value of these reserves ahead of inflation, maintaining spending power as well as offering capital growth to support charitable objectives. Taking advice to manage the balance of equities between short, medium and long-term reserves through time is therefore crucial for charities, whether funding a future capital project or seeking to grow the asset base for long-term financial security. With these new options available to them, Trustees have decisions to make on the best strategy for the charitable organisation they serve.

The value of investments and any income from them can fall and you may get back less than you invested. Neither simulated or actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. This information is provided only as an example and is not a recommendation to pursue a particular strategy.

This article was written by Lynne Lamont, Head of Charities UK at Brewin Dolphin, and James Flett, Investment Manager at Brewin Dolphin.

Information contained in this article is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Opinions expressed in this publication are not necessarily the views held throughout RBC Brewin Dolphin Ltd. Forecasts are not a reliable indicator of future performance.