Securing the future: succession planning for small businesses

In a post-pandemic world, the resilience of small businesses is being tested like never before. The exceptional challenges brought about by Covid-1...

Read More

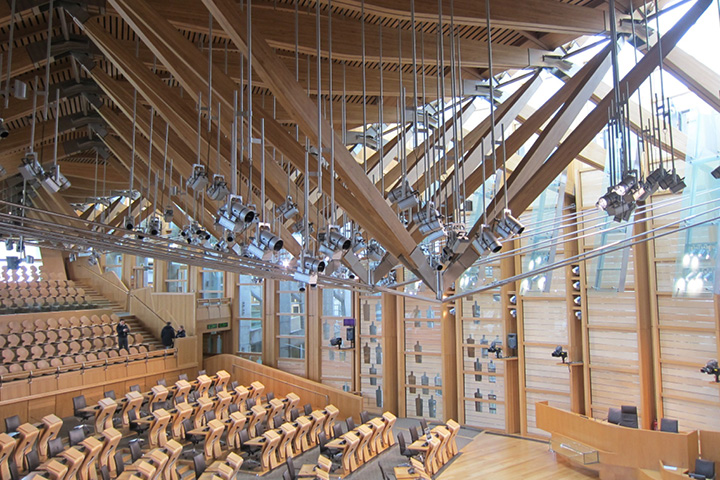

While history was made when Kate Forbes, the youngest ever Scottish Public finance minister laid out the Scottish Government’s Budget for 2020-2021, the Budget proposed a significant change for commercial leasing in Scotland.

It may appear that the change brings the tax rate for high value leases into line with England, however, it is important to note that the higher tax charge applies to lower value leases in Scotland when compared to England.

The changes take immediate effect for transactions not concluded before today.

So what does this actually mean for tenants – and landlords – of commercial property in Scotland going forward?

Under the proposed changes, a new 2% LBTT band will be introduced for leases of commercial property and will apply where a transaction has an NPV (Net Present Value) of above £2 million. In England, the higher tax rate kicks in only above an NPV of £5 million.

The change primarily affects tenants who are liable to pay the tax, adding not only an upfront tax cost when entering into the lease but additional costs throughout the term of the leases if their rents rise. Landlords may well also see the indirect effects of the tax hike when negotiating commercial rents with new tenants as they look at ways to offset the increased charges. It will be particularly important for tenants and landlords with portfolios north and south of the border where different thresholds (and tax authorities) apply to get the tax right.

Eligible contracts or leases entered into prior to 6 February will be unaffected by the changes, which take effect from 7 February. There is a further concession for pre-existing leases: any assignations or three year returns made in respect of those leases will not be charged at the higher rate. Again, it will be important for tenants to know the rules so that they ensure they pay the correct tax in each case.

LBTT Rates and Bands for non-residential leases are now as follows:

| Non-residential property leases | |

|---|---|

| Net present value of rent payable | LBTT rate |

| Up to £150,000 | 0% |

| £150,001 to £2 million | 1% |

| Over £2 million | 2% |

This year’s Budget did not propose any changes to the existing residential and non‑residential LBTT rates and band.

The ADS rate will also stay at 4% where applicable on purchases of residential property for the present time. However, home owners and landlords of portfolios of residential properties should be aware that the Scottish Government is considering ‘the range of views in relation to the operation of the ADS.’

Only time will tell as to what this means for purchasers of residential property in Scotland.

These changes will be subject to a successful passage of the Budget through Parliament and further detail on all of these changes will be provided when the draft bill is published.

We will continue to update as more information is given. We have a large number of tax, property and legal specialists who have are able to provide you with practical, commercial and tax-effective solutions to guide you through these new changes.